All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Holding cash in an IUL dealt with account being attributed rate of interest can usually be much better than holding the cash money on down payment at a bank.: You've always desired for opening your very own bakery. You can obtain from your IUL plan to cover the first expenditures of renting out a room, purchasing devices, and hiring team.

Individual car loans can be acquired from traditional financial institutions and credit scores unions. Right here are some key factors to think about. Charge card can give a versatile way to obtain cash for really temporary durations. Obtaining money on a credit history card is generally extremely pricey with yearly percent prices of rate of interest (APR) commonly reaching 20% to 30% or more a year.

The tax therapy of plan loans can differ dramatically depending on your country of residence and the certain terms of your IUL plan. In some regions, such as North America, the United Arab Emirates, and Saudi Arabia, policy finances are generally tax-free, supplying a significant advantage. Nevertheless, in various other territories, there may be tax implications to take into consideration, such as potential taxes on the funding.

Term life insurance policy only provides a death advantage, with no money worth build-up. This suggests there's no cash worth to borrow versus. This post is authored by Carlton Crabbe, President of Resources for Life, an expert in providing indexed global life insurance policy accounts. The info offered in this article is for educational and informative objectives just and must not be taken as economic or financial investment suggestions.

Whole Life Insurance As A Bank

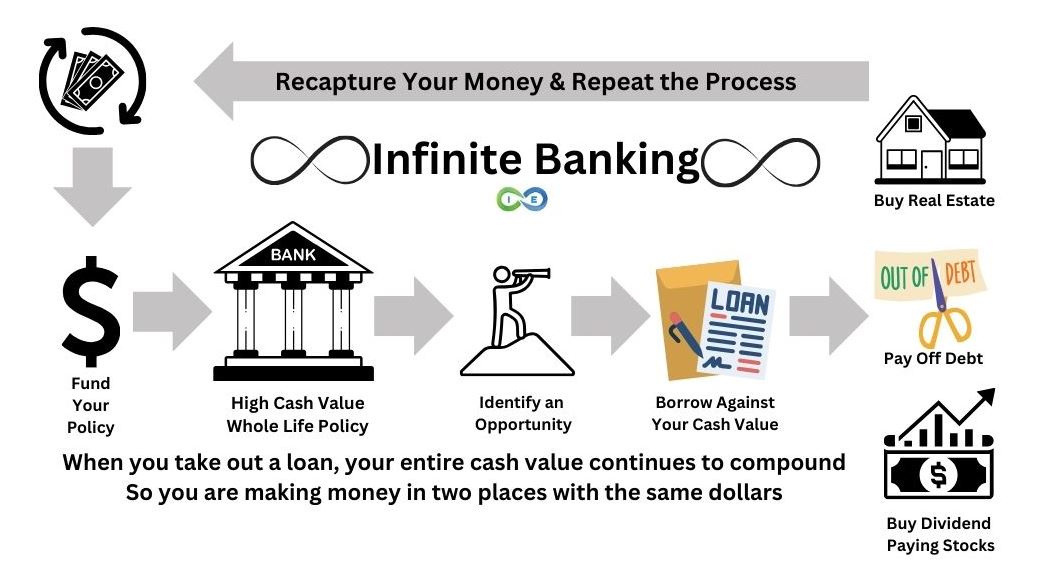

Envision entering the financial cosmos where you're the master of your domain, crafting your very own course with the skill of a seasoned banker however without the constraints of towering establishments. Invite to the world of Infinite Financial, where your financial fate is not simply an opportunity yet a tangible truth.

Uncategorized Feb 25, 2025 Cash is just one of those things all of us deal with, but many of us were never truly taught just how to use it to our advantage. We're informed to save, spend, and budget plan, but the system we operate in is designed to keep us based on financial institutions, continuously paying passion and fees just to accessibility our own money.

She's an expert in Infinite Financial, a strategy that assists you take back control of your financial resources and construct genuine, long lasting wealth. It's a real method that well-off households like the Rockefellers and Rothschilds have actually been utilizing for generations.

Currently, before you roll your eyes and believe, Wait, life insurance? This is a high-cash-value policy that permits you to: Store your money in a place where it grows tax-free Borrow against it whenever you need to make financial investments or significant purchases Earn nonstop compound passion on your money, even when you borrow against it Think regarding just how a financial institution functions.

With Infinite Financial, you become the financial institution, gaining that passion rather of paying it. For many of us, cash moves out of our hands the second we obtain it.

Infinite Banking Concept Pros And Cons

The insurer doesn't need to get "repaid," due to the fact that it will simply be deducted from what gets distributed to your beneficiaries upon your expiration day, as Hannah so euphemistically called it. You pay yourself back with rate of interest, similar to a financial institution wouldbut now, you're the one profiting. Allow that sink in.

It's concerning rerouting your money in a manner that develops wide range rather than draining it. If you remain in genuine estateor intend to bethis strategy is a found diamond. Let's claim you desire to buy a financial investment building. Instead of mosting likely to a financial institution for a car loan, you borrow from your very own policy for the deposit.

You utilize the lending to purchase your property. Rental revenue or earnings from the offer pay back your policy rather than a bank. This suggests you're constructing equity in your policy AND in property at the exact same time. That's what Hannah calls double-dippingand it's specifically just how the wealthy keep growing their money.

Nelson Nash Reviews

Below's the thingthis isn't a financial investment; it's a cost savings approach. Your cash is ensured to expand no matter what the stock market is doing. You can still invest in actual estate, supplies, or businessesbut you run your cash via your policy first, so it keeps expanding while you invest.

Ensure you work with an Infinite Financial Principle (IBC) expert who recognizes exactly how to establish it up correctly. This strategy is an overall state of mind shift. We have actually been trained to believe that banks hold the power, however the truth isyou can take that power back. Hannah's household has been utilizing this strategy given that 2008, and they now have more than 38 policies funding realty, investments, and their household's economic heritage.

Becoming Your Own Banker is a text for a ten-hour course of direction concerning the power of dividend-paying entire life insurance. The sector has actually concentrated on the fatality benefit high qualities of the agreement and has actually overlooked to properly explain the funding abilities that it offers for the policy proprietors.

This publication demonstrates that your need for money, throughout your life time, is much better than your requirement for protection. Fix for this demand through this instrument and you will wind up with more life insurance coverage than the companies will provide on you. Many everybody recognizes with the truth that a person can obtain from a whole life plan, but due to just how little costs they pay, there is limited access to cash to fund significant products needed during a life time.

Actually, all this book includes to the formula is scale.

Table of Contents

Latest Posts

Be Your Own Bank

Infinite Banking Explained

Cash Flow Whole Life Insurance

More

Latest Posts

Be Your Own Bank

Infinite Banking Explained

Cash Flow Whole Life Insurance